Updated:

Thane, Mumbai Metropolitan Region

G Corp Tech Park is a Grade A+ commercial office development on the main Ghodbunder Road in Thane, MMR of which PropShare Titania is spread across six floors and has a leasable area of 4,37,973 square feet.

PropShare Titania is fully leased (as of March 31, 2025) to a mix of Fortune 500 companies , multinational companies and bluechip tenants, including Aditya Birla Capital (and its subsidiaries) – an Indian MNC conglomerate operating in the BFSI sector, Concentrix – an American Fortune 500 MNC operating in the technology sector, a Fortune 500 Healthcare company operating in the healthcare and life sciences sector and a Japanese MNC conglomerate, operating in the technology sector. (Source: JLL Report)

G Corp Tech Park has been certified with ESG certifications, including LEED Platinum (O&M), WELL Health and Safety rating and BEE 5 Star certification.

LEED Platinum

Operations and Maintenance

WELL HSR

Well Health Safety Rating (May’23)

5-Star BEE

Bureau of Energy Efficiency

G Corp Tech Park is on Ghodbunder Road, a key road connecting Thane to the eastern suburbs on one side and to the Western suburbs of Mumbai on the other.

G Corp Tech Park will be at a walking distance (~300 meters) from the upcoming Kasarvadavali Station on the upcoming metro line 4, which will provide eastern connectivity within MMR between Wadala and Gaimukh, Thane. Further with the existing Eastern Express Highway, central railway, monorail and the ongoing works on metro lines 2B, 5 and 6. (Source: JLL Report)

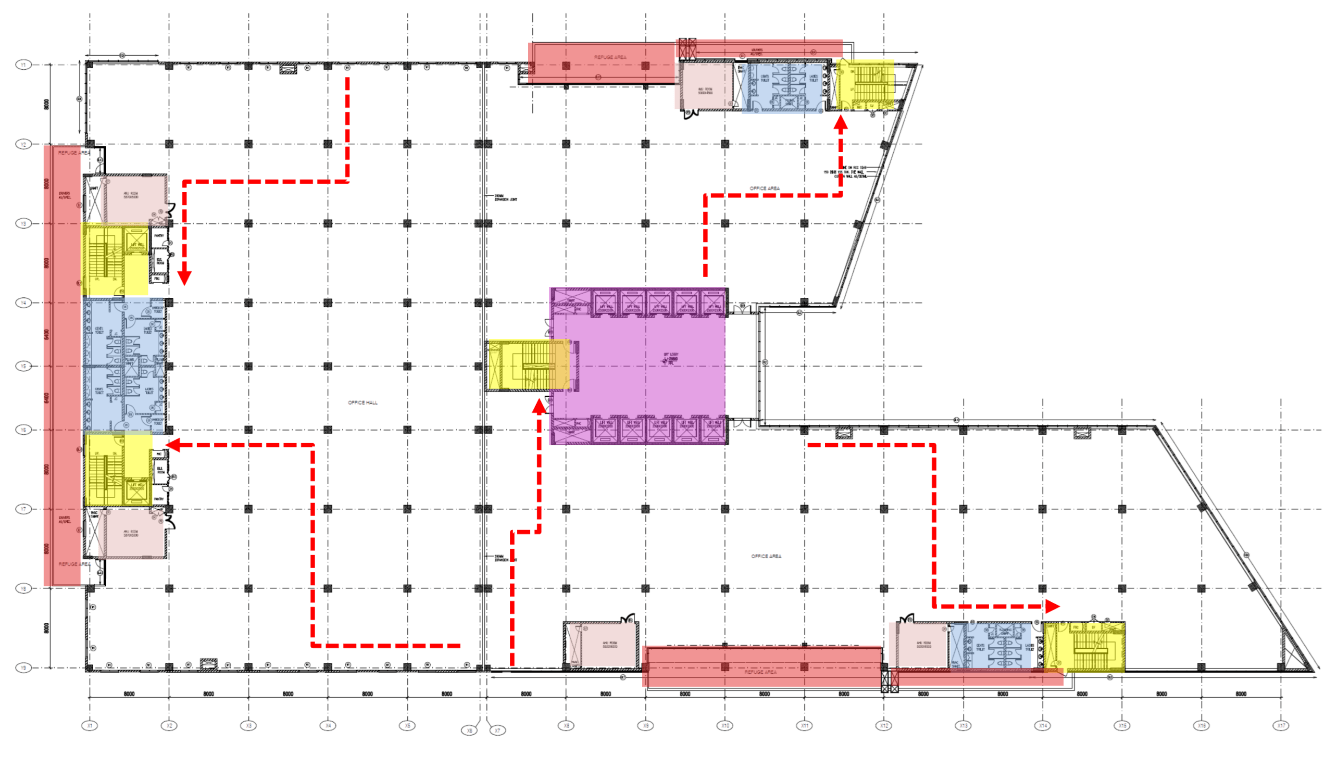

Proposed Titania is proposing to acquire 4,37,973 sq.ft spread across six floors.

Disclaimer: Please refer to ‘Annexure 3: Technical DD Report’ in the Key Information of the Scheme for further details

| Particulars | FY26 | FY27 | FY28 | FY29 |

|---|---|---|---|---|

| Net distributions to Investors (₹ Mn) | 425.71 | 425.32 | 427.01 | 412.32 |

| Projected Yield (%) | 9.0% | 9.0% | 9.0% | 8.7% |

| Post-Tax Projected Yield | 7.0% | 7.1% | 7.4% | 7.3% |

Assumed that the investor has not opted for taxation under Section 115BAC of the Income-tax Act, 1961.

The NDCF for PropShare Titania Scheme has been presented for the asset proposed to be owned by the PropShare Titania scheme as per offer document and statutory audit report. Please refer to ‘Annexure 1: Projections’ in the Key Information of the Scheme for further details. The above are projected yields(%), and the investment manager does not provide any assurance or guarantee of any distributions to the Unitholders.

Investors opting to be taxed under the new income tax regime introduced under Section 115BAC of the Income-tax Act, 1961, may benefit from a reduced surcharge rate structure.