How to analyse commercial leases

Commercial leases are very different from residential leases, which tend to be structured with standard 11-month tenure and an escalation at the end of the term. Residential leases are C2C meaning between two individuals – the landlord and the tenant and therefore tend to be less professionally drafted. Commercial leases, however, are generally B2B or C2B as the tenant is a company in most cases. In this blog, we will understand how commercial leases work and how an investor in commercial property should analyse them.

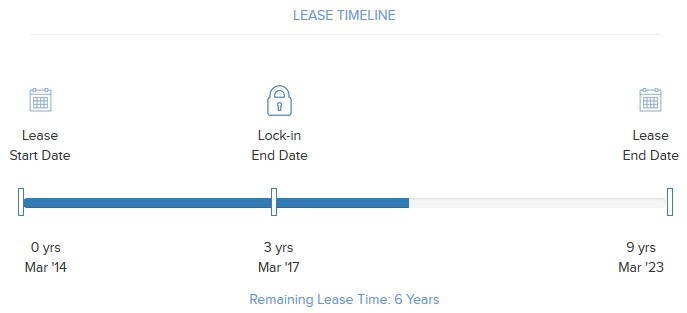

Lease Term: Contrary to residential leases, commercial leases are structured as 3+3+3 or 5+5+5. What does this mean? 3+3+3 means a 9-year lease with escalations every 3 years. Escalations typically range between 12-15% every 3 years and are meant to index the rent to inflation. Three and five year leases are rare in commercial offices.

This is because the tenant invests significantly in interior fit-outs (Standard fit-outs costs are Rs. 800-1,200 per sf) as offices are handed over in a bare shell form. A good way to visualize a bare shell floor is to think of a car parking area in your apartment. It does not come with a finished ceiling or flooring. The tenant needs to drop the ceiling or raise the floor for wiring, lighting, AC vents and invest in cubicles, desks, conference rooms. In order to recover the costs, the tenure needs to be 9 years or more.

Bareshell: How office floors are delivered to tenants in India

Lock-in: Almost every commercial lease will have a lock-in. Lock-in periods are generally 3 years. During the lock-in period, a tenant cannot vacate the premises providing the landlord with a stability of rental income. Compared to residential apartments, commercial floors are larger in size and take longer to lease. Brokerages are also higher at 2-3 months rent. Landlords, therefore, insist on a lock-in period in order to protect themselves from volatility in the lease.

Notice period: A standard notice period in a commercial lease ranges between 3 and 6 months for reasons similar to what we discussed above – longer lease-up times. 3-6 month notice periods give landlords an opportunity to find a new tenant without losing rent for longer periods of time.

Lease Break clauses: Lease break clause refers to the right of either party to break the lease. This is an important clause that is different in India vs. other countries. In India, the landlord cannot ask the tenant to leave during the lease term but the tenant can give notice and leave at any time after the lock-in period is over. It is referred to as a “one-sided break clause”. This again stems from the fact that the tenant makes significant investments in the interior fitouts which would be lost if the landlord were to ask him to leave before the lease period.

Market Yield Vs In-place yield: This creates an important anomaly in the rent structure. Rents in the top cities in India have been growing at 10-12% per year, which is much higher than the contracted escalations of 12-15% every 3 years built into the leases. Over a 15-year lease period, the tenant will end up paying significantly lower rents compared to the market.

For example in Embassy Golf Links, Bangalore, IBM signed a lease in 2003 at Rs. 30 per sf on a 5+5+5 lease with 12% escalations every 3 years ending in 2018. However, with the rapid growth in the city, rents in Golf Links grew to Rs. 125 per sf by 2012/13 while IBM was paying Rs. 42.2 per sf (after 3 escalations), a whopping 66% lower than the market.

This restricts the value of the property as commercial real estate sells at a “yield” (also called cap rate), which is rent divided by price. In an under the rented building, the cap rate becomes much lower forcing the landlord to sell at a lower price. For example, a new lease in Golf Links would sell for Rs. 15,000 per sf which would imply a yield of (125*12)/15,000 = 10.0%. However, the IBM lease would imply a yield of (42.2*12)/15,000 = 3.4% at that price.

At Property Share we pay a lot of attention to the market yield (yield at market rent) vs. the in-place yield (yield at current rent). A higher market rent yield tells us that there is upside potential in the investment if we can wait till the lease tenure is over or if the tenant decides to vacate mid-way. It also indicates safety, as a tenant is unlikely to leave if the market yield is higher. The reverse is true if the market yield is lower. In such a case we are wary, as the incentive for a tenant to leave is higher since he can switch to a new office building for lower rents. This happens if there is an oversupply in that particular market.